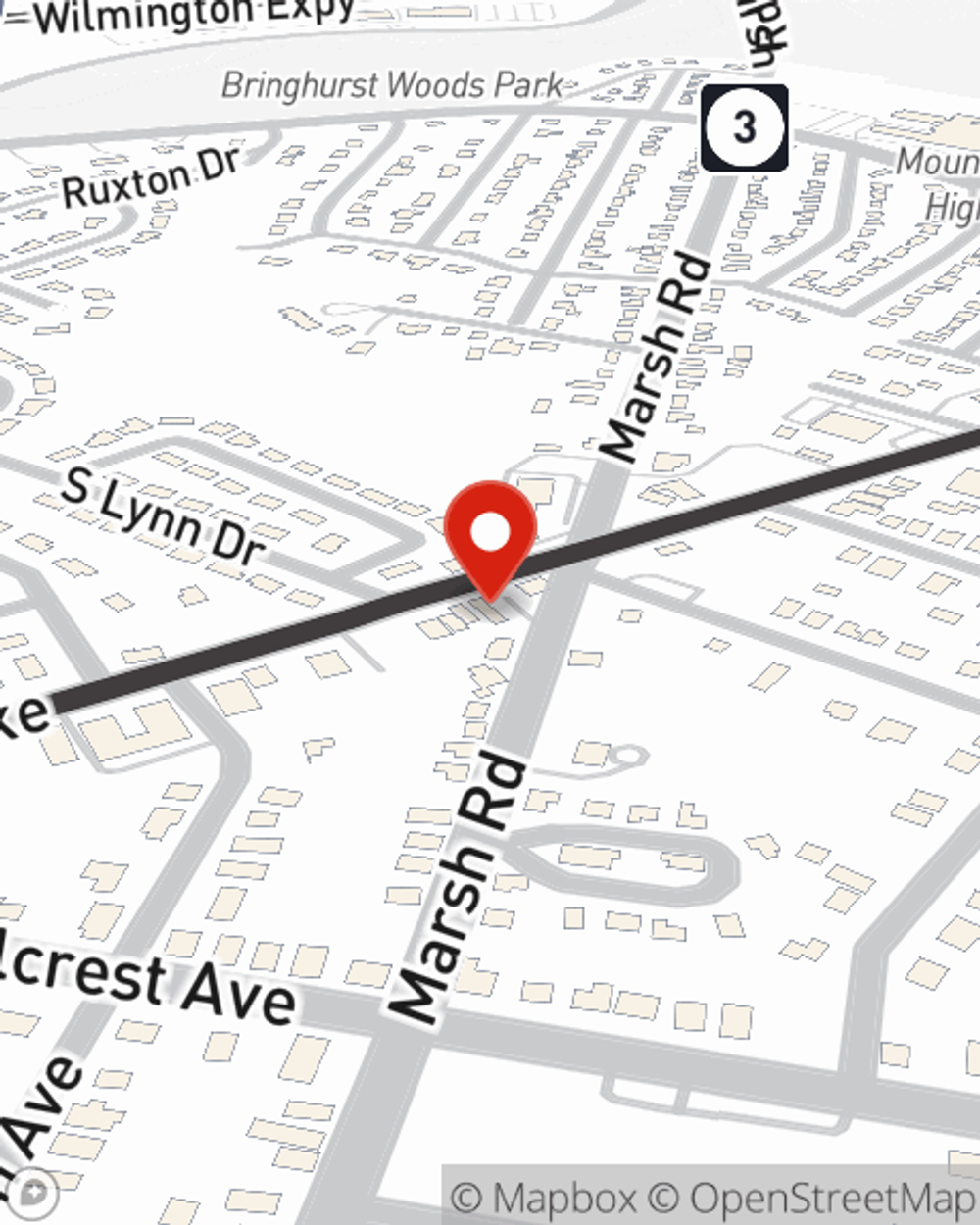

Business Insurance in and around Wilmington

Calling all small business owners of Wilmington!

Insure your business, intentionally

- Wilmington

- New Castle County

- Claymont

- Edgemoor

Insure The Business You've Built.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Raleigh Collins Jr help you learn about terrific business insurance.

Calling all small business owners of Wilmington!

Insure your business, intentionally

Surprisingly Great Insurance

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your take-home pay, but also helps with regular payroll expenses. You can also include liability, which is important coverage protecting your financial assets in the event of a claim or judgment against you by a visitor.

Get in touch with the terrific team at agent Raleigh Collins Jr's office to discover the options that may be right for you and your small business.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Raleigh Collins Jr

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.